If you want to use Quicken classes, create them before setting up your export preferences in your payroll account. You can use classes to group your expenses by departments, locations, or any other meaningful breakdown of your business. Quicken classes allow you to classify your payroll expenses. If you use subcategories, use a colon to separate the category name from the subcategory for example: Payroll:Gross Wages (no space before or after the colon).If you use subaccounts, use a dash to separate the account name from the subaccount for example: Payroll-Federal Taxes (no space before or after the dash).To find the names of categories for employee wages and employer payroll taxes, choose Tools > Category List.

(For cash advance and loan repayment, use asset accounts.) Find the name of the bank account you use to write payroll checks and the liability accounts you use for tax and deduction liabilities.

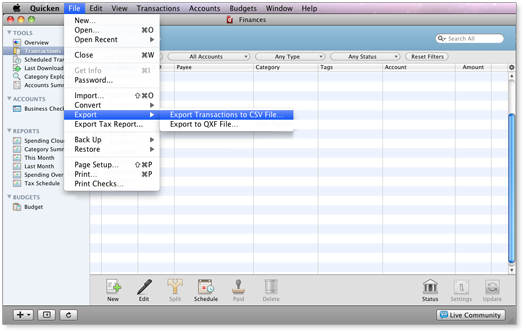

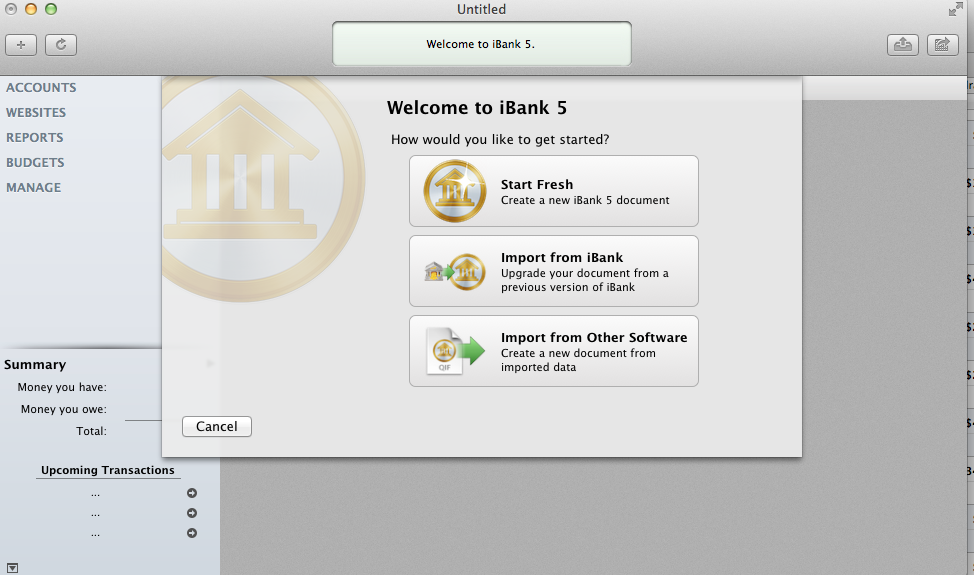

This article provides detailed instructions on how to export to Quicken and what to do each time you run payroll.

0 kommentar(er)

0 kommentar(er)